Immoscoring Group, Leipzig (Germany)

September 2009 - present

Founder and Shareholder

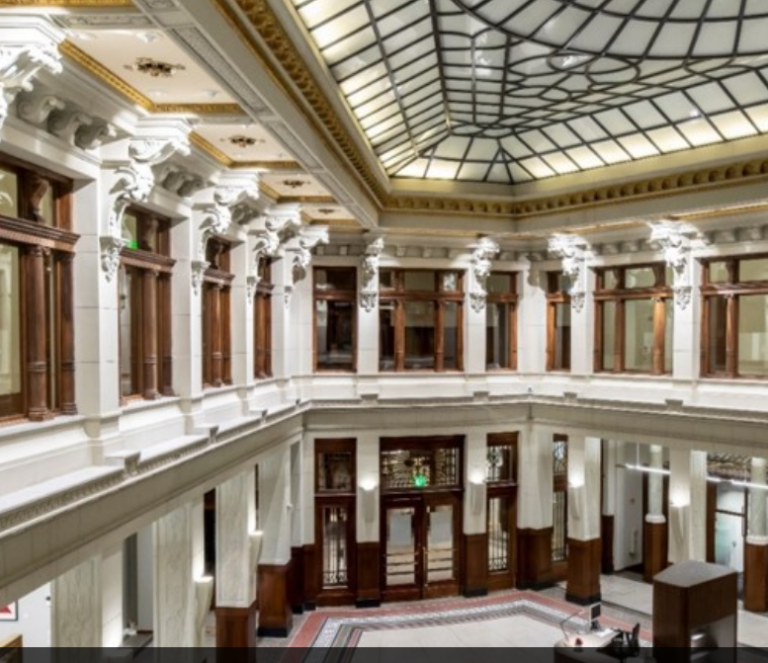

After several years of working as a financial advisor, there was an increasing demand among my clients and banking partners for real estate investment opportunities. In 2009, I therefore co-founded Immoscoring GmbH as a shareholder, retaining 50% ownership. Today, the Immoscoring Group possesses a highly diversified portfolio of properties in East Germany, comprising slightly over 20,000 square meters spread across approximately 350 rental units.

CEO

As the managing director of Immoscoring GmbH since its inception, I have been responsible for its growth and prosperity. I am proud to say that over the past 15 years since its founding, we have succeeded in establishing Immoscoring as a successful player in the market with a strong portfolio of properties.

Building diverse and multi-company structured real estate portfolios

The portfolio of the Immoscoring Group now encompasses a total of 9 individual companies, each with different arrangements depending on the type or location of the property. Through this structuring, we leverage tax and legal advantages and make the overall portfolio more manageable.

Investor relationship management

For several years, I have been collaborating with a group of investors for the acquisition of individual projects. These investors are provided with all essential decision criteria before the commencement of a project and are then continuously updated on the progress throughout the project phases until completion.

Lectus Geldwerk AG, Leipzig (Germany)

December 2019 - March 2024

Founder and Shareholder

To meet the increasing demand from customers for financial planning and investment services, I co-founded a sister company of Lectus Finanzen GmbH: Lectus Geldwerk AG (please see below for Lectus Finanzen). After a highly successful initial phase, which surpassed the original plans and expectations significantly, I sold my shares to the two co-founders of this company in early 2024.

Chairman of the Supervisory Board

After the establishment of this company, I assumed the role of Chairman of the Supervisory Board. This new position provided me with the opportunity to gain new perspectives on overseeing daily business operations and shaping the strategic direction of a company. By summer 2024, I will have retired from this position.

Supervisory Role

The monitoring function of a supervisory board fundamentally differs from that of daily management. In my new role as Chairman of the Supervisory Board, I was able to gain many new perspectives and ways of thinking as a result.

Business development as a Shareholder

Following the establishment of Lectus Geldwerk AG at the end of 2019, the primary objective was to successfully establish this new company despite the onset of the Covid-19 pandemic. Today, this company already manages client funds amounting to more than 30 million Euros, and further acquisitions are planned to achieve growth up to 50+ million Euros by the end of 2025.

Lectus Finanzen GmbH, Leipzig (Germany)

July 2005 - January 2024

Founder and Shareholder (2005 - 2024)

In 2005, I founded my first company, Lectus Finanzen GmbH. After having withdrawn from active management some time prior, I gradually sold my shares in this company to the new owner from June 2023 to January 2024, thereby stepping down from my role as a shareholder since then.

Managing Director (2005 - 2019)

Overall, I served as the managing director of Lectus Finanzen GmbH for nearly 15 years since its founding. During this time, the company grew to convey a yearly volume of over 150 million Euros in mortgage credit financing, making it one of the market leaders in Germany for complex credit structures.

Building Entrepreneurship

When I founded my first company, Lectus Finanzen GmbH, in 2005, a new era began for me. This marked the start of a new and unfamiliar field with new and sometimes unknown challenges. It also marked the beginning of an almost 20-year success story of entrepreneurship in my career.

Employee Recruitment

To meet the constantly increasing demand of customers, it required a continuously growing team of well-trained and motivated employees. Traditional advertisements through job centres often proved to be unsuccessful. During this time, I learned how to recruit new members for a team and effectively integrate them into the company in the long term.

Deutsche Bank AG, Leipzig (Germany)

August 1997 - June 2005

Consultant for Private and Business Clients

My job at Deutsche Bank was focused on consulting private and business clients mainly with a background need of mortgage or business financing. I had a close relationship to many of my entrepreneurial customers, some of whom inspired me to start my own business in 2005.

Training supervisor

After finishing my vocational training, I became a training supervisor on my own. In this position I had the opportunity to educate fresh career starters and to help them with their first steps into the banking world. Today, several of these young professionals belong to the best banking veterans at Deutsche Bank and other banks in Germany.

Fundamental Knowledge in Financing and Mortgage

My time at Deutsche Bank was full of learning and training. I am very much grateful for the profound knowledge I gained during these eight years through internal and external degree programmes and the huge amount of experience the older colleagues shared with me.

1st Leadership Position

Due to my role as a training supervisor, I was able to gain initial leadership experience. These experiences were very valuable to me and laid an important foundation for my subsequent successes in the development of my employees.

© Copyright. All rights reserved.

Wir benötigen Ihre Zustimmung zum Laden der Übersetzungen

Wir nutzen einen Drittanbieter-Service, um den Inhalt der Website zu übersetzen, der möglicherweise Daten über Ihre Aktivitäten sammelt. Bitte überprüfen Sie die Details in der Datenschutzerklärung und akzeptieren Sie den Dienst, um die Übersetzungen zu sehen.